For once AUKUS is not dominating discussion about nuclear powered submarines… ⬇️

This week on the sidelines of APEC news broke that the US President has granted approval for South Korea to build nuclear powered submarines in the United States. Korean prime Hanwha Group has pledged to invest billions in upgrading the shipyards it has purchased in Philadelphia which will be the facility used for construction of the future South Korean nuclear powered submarine.

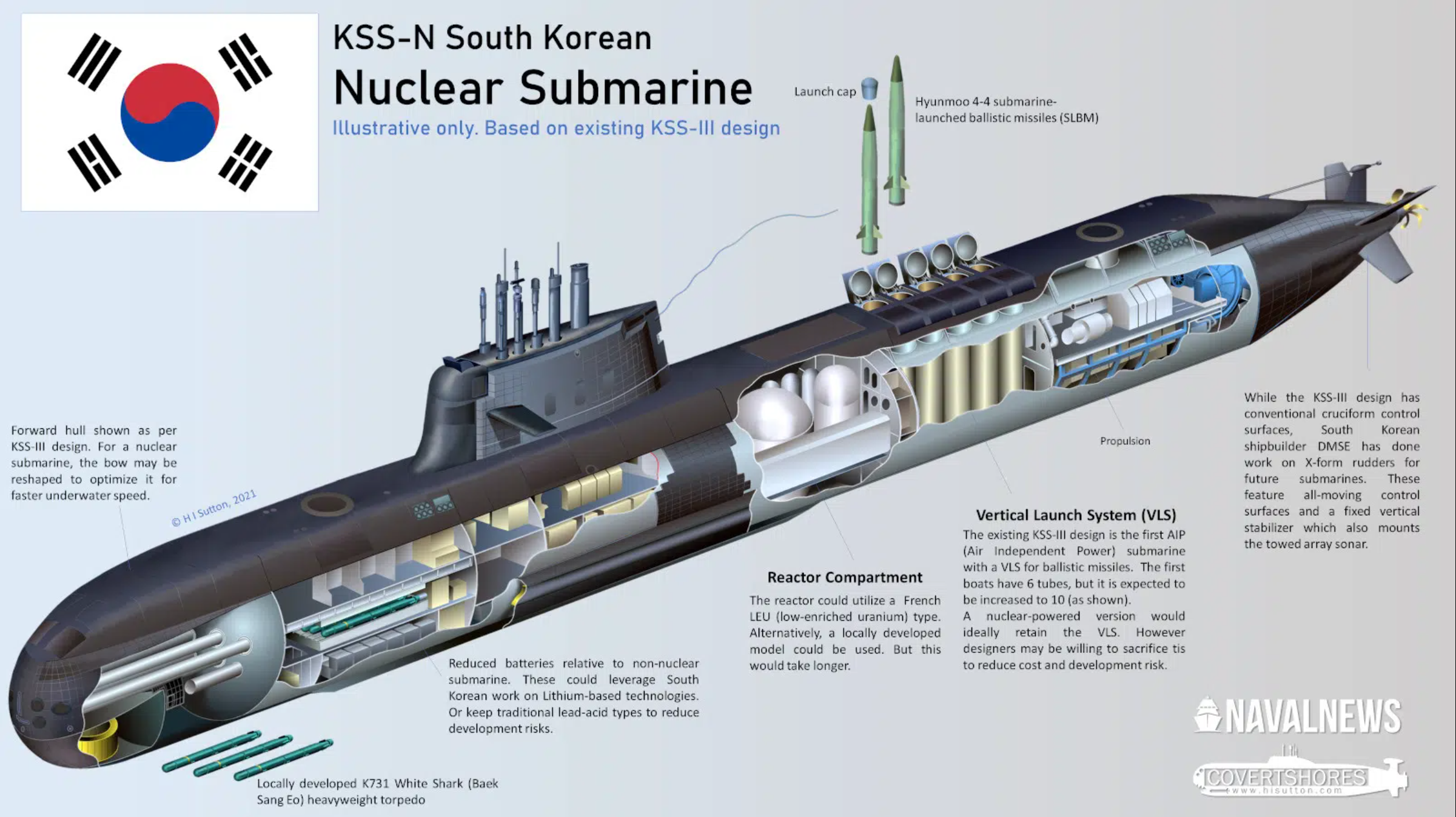

As part of the deal, the US will transfer nuclear propulsion technology to South Korea. What is unclear is if this will result in a nuclear powered variant of South Korea’s KSS class or even an additional assembly line for the US Virginia class submarines that will be in service with the Royal Australia Navy in the next decade. Naval Technology speculates a nuclear KSS variant is the most likely choice but there could be commonality in propulsion with the Virginia class:

“More likely would be a nuclear-powered KSS-III variant, bringing design commonality across its submarine fleets. South Korea has a considerable civil nuclear energy programme and has many of the required skills to operate and sustain naval nuclear propulsion. It is possible that the nuclear propulsion provision could be centred around the S9G pressurised water reactor used by the Virginia SSNs, which can operate for over 30 years without refuelling.”

South Korea building and operating nuclear submarines is a clear benefit for the region and opens potential options for Australia and the United States in the future. Hanwha Group already owns a substantial stake in Australia’s Austal shipbuilding company and has a request in with the Foreign Investment Review Board to double its current stake to 19.9 per cent of the company. HMAS Stirling and Henderson as a nuclear maintenance and support facility with continues to grow in strategic importance in our region, offering both access to the Indo-Pacific and distance from the pacing threat that allies and partners such as Japan and South Korea could increasingly value.

On shipbuilding more generally, only South Korea and Japan are the only large competitors to Chinese shipbuilding dominance of the global commercial market – Chinese shipbuilders make up 70% of global market share followed by South Korea with 17% and Japan at 13% currently. The CSIS ‘Ship Wars’ report shows how China is leveraging its dual-use shipbuilding empire to gain a sustainable competitive advantage in growing its naval capability and capacity:

“In addition to building massive numbers of commercial ships, many Chinese shipyards also produce warships for the country’s rapidly growing navy. As part of its “military-civil fusion” strategy, China is tapping into the dual-use resources of its commercial shipbuilding empire to support its ongoing naval modernization.”

Food for thought as always – articles mentioned are in the comments.

🖼️ by HI Sutton via Naval News